The poor economic performance of the United States, including the antagonism the Obama administration has for business in general, has meant that the economic recovery of the United States has been very slow, weak, and incomplete. That also affects countries in the rest of the world, so the economic slowdown damaged both the U.S. and other countries as well that typically would conduct commerce with the U.S. Although there has not been a true world-wide economic crash, there has also not been a true recovery, and many countries are now seeking to unload U.S. Treasury bonds in order to prop up their own economies.

U.S. Treasuries have always been considered the most safe and secure place for countries to invest and insure against calamity, and now that position and belief is slipping away as Obama dithers and rules in ways that will extend the economic downturn even longer.

China, Russia and Brazil sold off U.S. Treasury bonds as they tried to soften the blow of the global economic slowdown. They each sold off at least $1 billion in U.S. Treasury bonds in March.

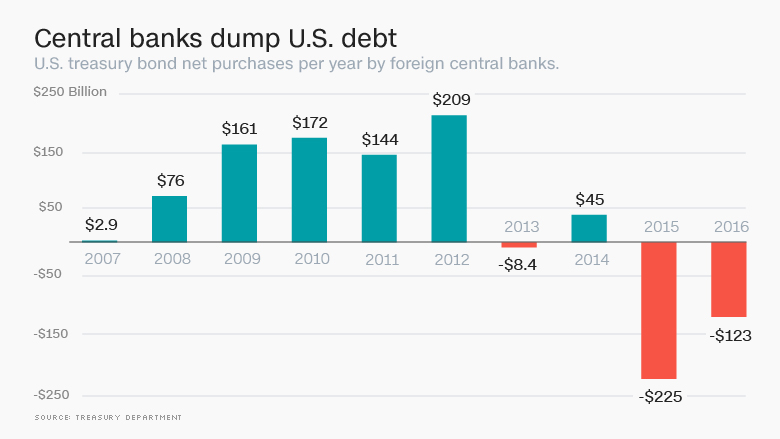

In all, central banks sold a net $17 billion. Sales had hit a record $57 billion in January.

So far this year, the global bank debt dump has reached $123 billion.

It’s the fastest pace for a U.S. debt selloff by global central banks since at least 1978, according to Treasury Department data published Monday afternoon.

Treasuries are considered one of the safest assets in the world, but some experts say a sense of panic about the global economy drove the selloff.

Judging by the selloff, policymakers across the globe were hitting the panic button often and early in the year as oil prices fell, concerns about China’s economy rose and stock markets were very volatile.

In response, countries may be selling Treasuries to prop up their currencies, some of which lost lots of value against the dollar last year. By selling U.S. debt, central banks can get hard cash to buy up their local currency and prevent it from losing too much value.

There is no question that a poor performing United States causes alarm throughout the world about the potential collapse of the world economy. That is a very real concern, and Obama has done nothing to assuage the fears of traders, and the concern of the citizens of the U.S. If one were to consider objectively the accomplishments of the Obama administration they would have to conclude that he could scarcely have done worse if he intentionally tried to cause economic hardship, distrust, and anger.

That will not be reported in the mainstream media, so know-nothing college kids, ethnic groups, and aging hippies will not admit that, but a graph such as the one above shows the truth. The rest of the world does not trust either Obama or the strength of the United States economy anymore. That is truly a crime.

Source: money.cnn.com

As america strays farther from Almighty God so closer to destruction america comes

This is only going to get worse. Obama & the rest of the ba**ards in government have destroyed our country for their own gain.

You could not be more wrong in your assessment of World Economey and US Administration and specially President Obama for the following reasons:

1. Countries who are dumping US debth to prop up their own currencies , are doing so because the value of their currencies are falling against the US Dollar as you explained . So that would be each individual countries problem and has nothing to do

With how secure US Treasuries are or are not .

2. The US Economey is Tanking because Capitalizem is becoming more Gridier than ever.

Since 1980 all Main Street businesses and Jobs went to , Wallmarts, Homdepots, and Rite Aids and other Gigantic non job producing companies, and they only produced more income for their CEO’s and Share Holders.

3. Since 1980 Grid has destroyed Factories in US and all of the Gient Corporations moved their productions to outside of US for more profit and recently they are parking their profits outside of US to Avoid Taxes you may say Corporate taxes in US is too high !? That is NOT true Corporate Taxes were over 70% for 40 years before 1980 & US never had a downturn in that period.

The best example of Grid is Apple makes IPhone in Chaina , parks its Money in foreign Banks and Wall Street calls Apple the best US Company, Apple Barows money to pay dividend to its share holders .

All of this ? ! Just to Avoid paying US Income Taxes?

All of the above has nothing to do with Obama or anyone in Whitehouse , the Corporations and Midia wants public to stay ignorant and uneducated so the public will buy anything they want to sell and obviously will pay most of their income taxes too.

Of course you would like to blame Obama or Administration , because who else can you blame ?

look at what you are selling on your own Website!?

JUNK

Only EDUCATION can save us because we are pretty uneducated and ignorant.

round 4 of the depression

Trump 2016 !!!

Spend thrift Obama Lol

So our Muslim President has Hijacked our economy and is putting it into a Nose dive to crash it INTO THE GROUND?…. Figures. 🙁

Let’s face it. He did what he set out to do. He got by with it. No surprise.No surprise.

It’s time we the people throw the federal reserve out of our country!