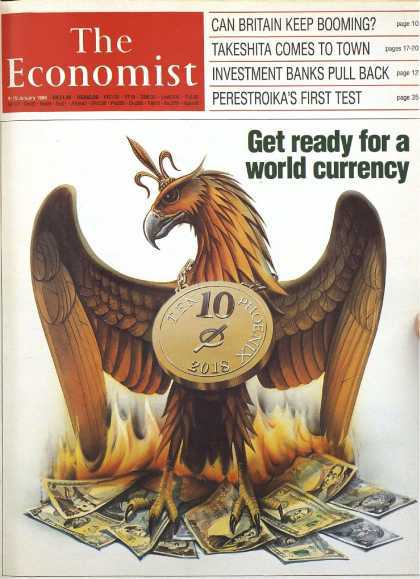

The Phoenix would impose restraints on governments, making national monetary policies irrelevant. This would prevent them from borrowing large amounts of money, and owing debts that stretch just north of $18 trillion. This, in turn, would reignite trade, investment and employment, three things that America is in desperate need of.

The world phoenix supply would be fixed by a new central bank, descended perhaps from the IMF. The world inflation rate – and hence, within narrow margins, each national inflation rate- would be in its charge. Each country could use taxes and public spending to offset temporary falls in demand, but it would have to borrow rather than print money to finance its budget deficit. With no recourse to the inflation tax, governments and their creditors would be forced to judge their borrowing and lending plans more carefully than they do today. This means a big loss of economic sovereignty, but the trends that make the phoenix so appealing are taking that sovereignty away in any case. Even in a world of more-or-less floating exchange rates, individual governments have seen their policy independence checked by an unfriendly outside world.

As the next century approaches, the natural forces that are pushing the world towards economic integration will offer governments a broad choice. They can go with the flow, or they can build barricades. Preparing the way for the phoenix will mean fewer pretended agreements on policy and more real ones. It will mean allowing and then actively promoting the private-sector use of international money alongside existing national monies. That would let people vote with their wallets for the eventual move to full currency union. The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today. In time, though, its value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power.

The alternative – to preserve policymaking autonomy- would involve a new proliferation of truly draconian controls on trade and capital flows. This course offers governments a splendid time. They could manage exchange-rate movements, deploy monetary and fiscal policy without inhibition, and tackle the resulting bursts of inflation with prices and incomes polices.

The phoenix doesn’t just sound like a good idea, it sounds like an idea that could restore America’s economy. It would hold governments responsible for careless spending and provide international economic stability. Alas, the odds of this happening are very slim. While it’s great in theory, the same people who created these economic problems are the ones preventing it from being fixed.

Source: socioecohistory.wordpress.com

Probably would have if Hillary was elected