About 4 million people — including the estimated 1 million low-income Americans must to pay the Obamacare penalty for 2016.

So how is that promise for insurance for everyone working out?

A report last week from the Congressional Budget Office estimated that 1 million Americans will be required to pay a penalty to the Federal government by the end of next year as a “tax” for declining to purchase health insurance under Obamacare’s individual mandate provision.

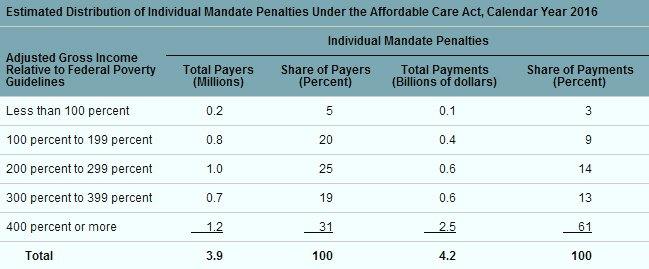

In all, CBO now expects about 4 million people — including the estimated 1 million low-income Americans who live below the government’s 200 percent poverty threshold — to pay the Obamacare penalty for 2016.

From the report:

“CBO and [the Joint Committee on Taxation] JCT’s estimates of the number of people who will pay penalties account for likely compliance rates as well as the ability of the Internal Revenue Service (IRS) to administer and collect the penalty payments.

All told, CBO and JCT estimate that about 4 million people will pay a penalty because they are uninsured in 2016 (a figure that includes uninsured dependents who have the penalty paid on their behalf). An estimated $4 billion will be collected from those who are uninsured in 2016, and, on average, an estimated $5 billion will be collected per year over the 2017-2024 period.

Of the 1 million Americans the government regards as “low-income,” roughly 200,000 will earn gross income of less than 100 percent of the government’s poverty baseline; another 800,000 will earn less than 200 percent of the gross income poverty line, which places them in a category of low-income earners eligible to receive a host of Federal poverty entitlements. For a breakdown of how the Department of Health and Human Services assesses “poverty” as a ratio of household size to annual income, see the department’s 2014 poverty guidelines.

The CBO graph below illustrates the Obamacare penalty forecast as a function of income demographics:

<a “nofollow”=”” href=”http://plnami.blob.core.windows.net/media/2014/06/CBO_graph.jpg” style=”color: #2255aa;”>

“In general, households with lower income will pay the flat dollar penalty (with adjustments to account for the lower penalty for children and the overall cap on family payments), and households with higher income will pay a percentage of their income,” the report indicates.

HOPE HE IS OUT ON HIS BACKSIDE WAY BEFORE 2016

Bull$#%&!@* don’t pay!

Obama care. ..the rich can afford it, the poor get it for free,and the middle class get another bill they can’t afford.

How do you like Obama now

Because Obama is black ! Oh and crazy! Everyone is afraid to offend the first black president.

How are those free “Obama phones” going to work out for you then. This is the very devil himself! Obama is single handedly destroying everything that this Nation has stood for, this man has made a sham of the Office of president. An then there are his minions that cover his butt of everything he does and screws up. He always gets close to breaking some big law but not quite enough. The United States used to be strong, respected and yes even feared, not anymore! We are a third would nation with illegal immigrants flooding our boarders. What about the American young has he given up on them? He is changing the face of America to one of Hispanic. They want voters for the future, let them in now! This man is not a man of the people, not a man of law, he is a liar and thee United States is a land of the lawless!

barry is a piece of c**p…

Screw you ODumbma!

Guess what, they didn’t believe any of the bad stuff, now it is happening!

Stick it.