About 4 million people — including the estimated 1 million low-income Americans must to pay the Obamacare penalty for 2016.

So how is that promise for insurance for everyone working out?

A report last week from the Congressional Budget Office estimated that 1 million Americans will be required to pay a penalty to the Federal government by the end of next year as a “tax” for declining to purchase health insurance under Obamacare’s individual mandate provision.

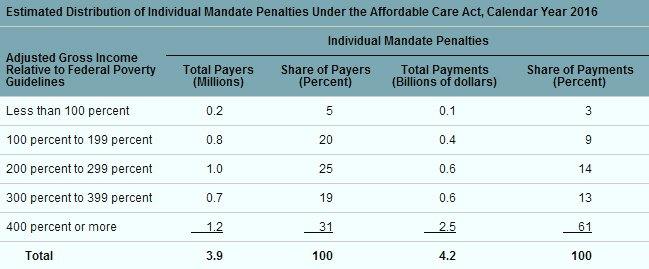

In all, CBO now expects about 4 million people — including the estimated 1 million low-income Americans who live below the government’s 200 percent poverty threshold — to pay the Obamacare penalty for 2016.

From the report:

“CBO and [the Joint Committee on Taxation] JCT’s estimates of the number of people who will pay penalties account for likely compliance rates as well as the ability of the Internal Revenue Service (IRS) to administer and collect the penalty payments.

All told, CBO and JCT estimate that about 4 million people will pay a penalty because they are uninsured in 2016 (a figure that includes uninsured dependents who have the penalty paid on their behalf). An estimated $4 billion will be collected from those who are uninsured in 2016, and, on average, an estimated $5 billion will be collected per year over the 2017-2024 period.

Of the 1 million Americans the government regards as “low-income,” roughly 200,000 will earn gross income of less than 100 percent of the government’s poverty baseline; another 800,000 will earn less than 200 percent of the gross income poverty line, which places them in a category of low-income earners eligible to receive a host of Federal poverty entitlements. For a breakdown of how the Department of Health and Human Services assesses “poverty” as a ratio of household size to annual income, see the department’s 2014 poverty guidelines.

The CBO graph below illustrates the Obamacare penalty forecast as a function of income demographics:

<a “nofollow”=”” href=”http://plnami.blob.core.windows.net/media/2014/06/CBO_graph.jpg” style=”color: #2255aa;”>

“In general, households with lower income will pay the flat dollar penalty (with adjustments to account for the lower penalty for children and the overall cap on family payments), and households with higher income will pay a percentage of their income,” the report indicates.

IMPEACH THE FRIGGIN TRAITOR

I’m not paying a cent KMA!! I didn’t vote for you, I don’t agree with you, You are illegal,null and void. You are NOT my president. This is NOT a democracy this is a Constitutional Republic and I do NOT have to listen to anybody. And if you want to waste $$$ on me by placing me in prison, I’m going to benefit, Healthcare Dental room and board and fed. So whos the dumbass now OBUMMER?! I STILL won’t pay.

Tyrant.

It won’t be long before Obamacare has all of us without the insurance of our choice and on a one payer system with the govt. controlling it all. Obama’s plan to begin with, make America a Socialist nation.

file your taxes and if you have a refund they will get the money

At least he lies equally to everyone, regardless of income!!

That is true Keith and Ken he is the most evil President we have ever had.

We got them were we want them.The no SHAME PRESIDENT..2014 2016

not in this lifetime he can kiss my royal ass

Most shameful man in US history he will pay for what he has done one way or the other