About 4 million people — including the estimated 1 million low-income Americans must to pay the Obamacare penalty for 2016.

So how is that promise for insurance for everyone working out?

A report last week from the Congressional Budget Office estimated that 1 million Americans will be required to pay a penalty to the Federal government by the end of next year as a “tax” for declining to purchase health insurance under Obamacare’s individual mandate provision.

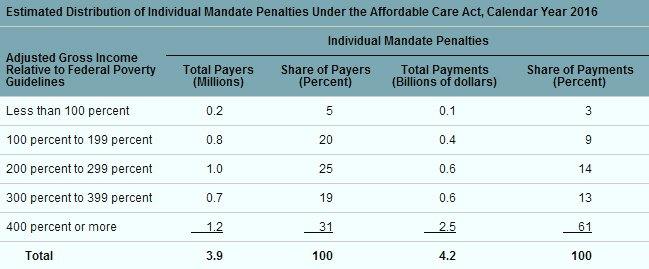

In all, CBO now expects about 4 million people — including the estimated 1 million low-income Americans who live below the government’s 200 percent poverty threshold — to pay the Obamacare penalty for 2016.

From the report:

“CBO and [the Joint Committee on Taxation] JCT’s estimates of the number of people who will pay penalties account for likely compliance rates as well as the ability of the Internal Revenue Service (IRS) to administer and collect the penalty payments.

All told, CBO and JCT estimate that about 4 million people will pay a penalty because they are uninsured in 2016 (a figure that includes uninsured dependents who have the penalty paid on their behalf). An estimated $4 billion will be collected from those who are uninsured in 2016, and, on average, an estimated $5 billion will be collected per year over the 2017-2024 period.

Of the 1 million Americans the government regards as “low-income,” roughly 200,000 will earn gross income of less than 100 percent of the government’s poverty baseline; another 800,000 will earn less than 200 percent of the gross income poverty line, which places them in a category of low-income earners eligible to receive a host of Federal poverty entitlements. For a breakdown of how the Department of Health and Human Services assesses “poverty” as a ratio of household size to annual income, see the department’s 2014 poverty guidelines.

The CBO graph below illustrates the Obamacare penalty forecast as a function of income demographics:

<a “nofollow”=”” href=”http://plnami.blob.core.windows.net/media/2014/06/CBO_graph.jpg” style=”color: #2255aa;”>

“In general, households with lower income will pay the flat dollar penalty (with adjustments to account for the lower penalty for children and the overall cap on family payments), and households with higher income will pay a percentage of their income,” the report indicates.

Remember, most cost increases are designed to go into effect after the elections…..so the uninformed will vote for the people who are putting the screws to them…again

Y the hell are we to be punished for a fuhquin choice of not having if we get sick we may die end of story

It’s always the people who can least afford stuff no matter what it is such as higher electric bills, water and land management taxes thanks EPA, higher taxes on everything, unaffordable health care plus penalties, everything that Obama does comes with a higher price tag for poor people while he touts it’s the rich he

Obamacare is about Obama. He was looking for his legacy as savior of the nation. His ego and motives were clearly revealed in the 2012 Presidential debates with Romney:

MR. ROMNEY:What things would I cut from spending? Well, first of all, I will eliminate all programs by this test — if they don’t pass it: Is the program so critical it’s worth borrowing money from China to pay for it? And if not, I’ll get rid of it. “Obamacare” is on my list. I apologize, Mr. President. I use that term with all respect.

PRESIDENT OBAMA: I like it.

Do not comply!

BULL$#%&!@*!

Yea checks in the mail ..

“Of All Tyrannies, A Tyranny Exercised For The Good Of Its Victims May Be The Most Oppressive.”

C.S. Lewis

WE ARE NOT A DEMOCRACY!!! WE ARE SUPPOSED TO BE A CONSTITUTIONAL REPUBLIC!!! >:/

ACA (Obamacare) is NOT HIPAA compliant. In other words there is no privacy here. That’s like giving all of your personal info along with bank account number and social security # to all the hackers of the world.

This guy who calls himself a president and his buddies know this and they don’t care.